false2024Q1000118534812/31http://fasb.org/us-gaap/2024#OtherAssetshttp://fasb.org/us-gaap/2024#OtherAssetshttp://fasb.org/us-gaap/2024#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherAssetshttp://fasb.org/us-gaap/2024#OtherAssetshttp://fasb.org/us-gaap/2024#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesCurrentxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureiso4217:EURiso4217:SEK00011853482024-01-012024-03-3100011853482024-05-0200011853482024-03-3100011853482023-12-3100011853482023-01-012023-03-310001185348us-gaap:CommonStockMember2023-12-310001185348us-gaap:AdditionalPaidInCapitalMember2023-12-310001185348us-gaap:RetainedEarningsMember2023-12-310001185348us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001185348us-gaap:NoncontrollingInterestMember2023-12-310001185348us-gaap:RetainedEarningsMember2024-01-012024-03-310001185348us-gaap:NoncontrollingInterestMember2024-01-012024-03-310001185348us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001185348us-gaap:CommonStockMember2024-01-012024-03-310001185348us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001185348us-gaap:CommonStockMember2024-03-310001185348us-gaap:AdditionalPaidInCapitalMember2024-03-310001185348us-gaap:RetainedEarningsMember2024-03-310001185348us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001185348us-gaap:NoncontrollingInterestMember2024-03-310001185348us-gaap:CommonStockMember2022-12-310001185348us-gaap:AdditionalPaidInCapitalMember2022-12-310001185348us-gaap:RetainedEarningsMember2022-12-310001185348us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001185348us-gaap:NoncontrollingInterestMember2022-12-3100011853482022-12-310001185348us-gaap:RetainedEarningsMember2023-01-012023-03-310001185348us-gaap:NoncontrollingInterestMember2023-01-012023-03-310001185348us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001185348us-gaap:CommonStockMember2023-01-012023-03-310001185348us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001185348us-gaap:CommonStockMember2023-03-310001185348us-gaap:AdditionalPaidInCapitalMember2023-03-310001185348us-gaap:RetainedEarningsMember2023-03-310001185348us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001185348us-gaap:NoncontrollingInterestMember2023-03-3100011853482023-03-310001185348praa:A2028NotesMember2024-01-012024-03-310001185348praa:A2028NotesMember2023-01-012023-03-310001185348praa:CorePortfolioSegmentMember2023-12-310001185348praa:InsolvencyPortfolioSegmentMember2023-12-310001185348praa:CorePortfolioSegmentMember2024-01-012024-03-310001185348praa:InsolvencyPortfolioSegmentMember2024-01-012024-03-310001185348praa:CorePortfolioSegmentMember2024-03-310001185348praa:InsolvencyPortfolioSegmentMember2024-03-310001185348praa:CorePortfolioSegmentMember2022-12-310001185348praa:InsolvencyPortfolioSegmentMember2022-12-310001185348praa:CorePortfolioSegmentMember2023-01-012023-03-310001185348praa:InsolvencyPortfolioSegmentMember2023-01-012023-03-310001185348praa:CorePortfolioSegmentMember2023-03-310001185348praa:InsolvencyPortfolioSegmentMember2023-03-310001185348us-gaap:PrivateEquityFundsMember2024-03-310001185348us-gaap:PrivateEquityFundsMember2023-12-310001185348praa:GovernmentBondsandFixedIncomeFundsMember2024-03-310001185348praa:GovernmentBondsandFixedIncomeFundsMember2023-12-310001185348praa:RCBInvestimentosS.A.Memberpraa:RCBInvestimentosSARCBMember2024-03-310001185348praa:AmericasRevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-03-310001185348praa:AmericasRevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-12-310001185348praa:UKRevolvingCreditMemberpraa:UKCreditAgreementMemberus-gaap:LineOfCreditMember2024-03-310001185348praa:UKRevolvingCreditMemberpraa:UKCreditAgreementMemberus-gaap:LineOfCreditMember2023-12-310001185348praa:EuropeanRevolvingFacilityandTermLoanMemberpraa:EuropeRevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-03-310001185348praa:EuropeanRevolvingFacilityandTermLoanMemberpraa:EuropeRevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-12-310001185348praa:NorthAmericanCreditAgreementMemberus-gaap:LoansPayableMember2024-03-310001185348praa:NorthAmericanCreditAgreementMemberus-gaap:LoansPayableMember2023-12-310001185348us-gaap:SeniorNotesMember2024-03-310001185348us-gaap:SeniorNotesMember2023-12-310001185348praa:NorthAmericanCreditAgreementMember2024-03-310001185348praa:NorthAmericanCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2024-03-310001185348praa:NorthAmericanCreditAgreementMemberpraa:CanadianRevolvingCreditFacilityMember2024-03-310001185348praa:EuropeanRevolvingFacilityandTermLoanMemberpraa:EuropeRevolvingCreditFacilityMembersrt:MaximumMember2023-01-012023-03-310001185348praa:EuropeanRevolvingFacilityandTermLoanMemberpraa:EuropeRevolvingCreditFacilityMembersrt:MaximumMember2024-01-012024-03-310001185348us-gaap:SeniorNotesMemberpraa:A2025NotesMember2020-08-270001185348us-gaap:SeniorNotesMemberpraa:A2028NotesMember2023-02-060001185348praa:A2029NotesMemberus-gaap:SeniorNotesMember2021-09-220001185348us-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-03-310001185348us-gaap:InterestRateContractMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-12-310001185348us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2024-03-310001185348us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2023-12-310001185348srt:MinimumMember2024-01-012024-03-310001185348srt:MaximumMember2024-01-012024-03-310001185348us-gaap:InterestRateContractMember2024-01-012024-03-310001185348us-gaap:InterestRateContractMember2023-01-012023-03-310001185348us-gaap:InterestRateContractMemberus-gaap:InterestExpenseMember2024-01-012024-03-310001185348us-gaap:InterestRateContractMemberus-gaap:InterestExpenseMember2023-01-012023-03-310001185348us-gaap:ForeignExchangeContractMemberus-gaap:ForeignCurrencyGainLossMember2024-01-012024-03-310001185348us-gaap:ForeignExchangeContractMemberus-gaap:ForeignCurrencyGainLossMember2023-01-012023-03-310001185348us-gaap:ForeignExchangeContractMemberus-gaap:InterestExpenseMember2024-01-012024-03-310001185348us-gaap:ForeignExchangeContractMemberus-gaap:InterestExpenseMember2023-01-012023-03-310001185348us-gaap:CarryingReportedAmountFairValueDisclosureMember2024-03-310001185348us-gaap:EstimateOfFairValueFairValueDisclosureMember2024-03-310001185348us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001185348us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001185348praa:GovernmentBondsMemberus-gaap:FairValueInputsLevel1Member2024-03-310001185348us-gaap:FairValueInputsLevel2Memberpraa:GovernmentBondsMember2024-03-310001185348praa:GovernmentBondsMemberus-gaap:FairValueInputsLevel3Member2024-03-310001185348praa:GovernmentBondsMember2024-03-310001185348us-gaap:FairValueInputsLevel1Member2024-03-310001185348us-gaap:FairValueInputsLevel2Member2024-03-310001185348us-gaap:FairValueInputsLevel3Member2024-03-310001185348praa:GovernmentBondsMemberus-gaap:FairValueInputsLevel1Member2023-12-310001185348us-gaap:FairValueInputsLevel2Memberpraa:GovernmentBondsMember2023-12-310001185348praa:GovernmentBondsMemberus-gaap:FairValueInputsLevel3Member2023-12-310001185348praa:GovernmentBondsMember2023-12-310001185348us-gaap:FairValueInputsLevel1Member2023-12-310001185348us-gaap:FairValueInputsLevel2Member2023-12-310001185348us-gaap:FairValueInputsLevel3Member2023-12-310001185348us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2024-01-012024-03-310001185348us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2023-01-012023-03-310001185348us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2023-12-310001185348us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2023-12-310001185348us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-12-310001185348us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2024-01-012024-03-310001185348us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2024-01-012024-03-310001185348us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-01-012024-03-310001185348us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2024-03-310001185348us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2024-03-310001185348us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-03-310001185348us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2022-12-310001185348us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2022-12-310001185348us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2022-12-310001185348us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2023-01-012023-03-310001185348us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2023-01-012023-03-310001185348us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-01-012023-03-310001185348us-gaap:AccumulatedNetInvestmentGainLossIncludingPortionAttributableToNoncontrollingInterestMember2023-03-310001185348us-gaap:AccumulatedGainLossCashFlowHedgeIncludingNoncontrollingInterestMember2023-03-310001185348us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended March 31, 2024

☐ Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from ________ to ________

Commission File Number: 000-50058

PRA Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | | | 75-3078675 |

| (State or other jurisdiction of incorporation or organization) | | | | (I.R.S. Employer Identification No.) |

120 Corporate Boulevard

Norfolk, Virginia 23502

(Address of principal executive offices)

(888) 772-7326

(Registrant's Telephone No., including area code)

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | PRAA | NASDAQ Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

The number of shares of the registrant's common stock outstanding as of May 2, 2024 was 39,352,006.

Table of Contents

| | | | | | | | |

| |

| | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| Item 6. | | |

| | |

| Signatures | | |

Part I. Financial Information

Item 1. Financial Statements (Unaudited)

PRA Group, Inc.

Consolidated Balance Sheets

March 31, 2024 and December 31, 2023

(Amounts in thousands)

| | | | | | | | | | | |

| (unaudited) | | |

| March 31,

2024 | | December 31,

2023 |

| Assets | | | |

| Cash and cash equivalents | $ | 108,100 | | | $ | 112,528 | |

| | | |

| Investments | 58,879 | | | 72,404 | |

| Finance receivables, net | 3,650,195 | | | 3,656,598 | |

| | | |

| Income taxes receivable | 32,067 | | | 27,713 | |

| Deferred tax assets, net | 78,883 | | | 74,694 | |

| Right-of-use assets | 44,187 | | | 45,877 | |

| Property and equipment, net | 34,054 | | | 36,450 | |

| Goodwill | 411,846 | | | 431,564 | |

| Other assets | 63,971 | | | 67,526 | |

| Total assets | $ | 4,482,182 | | | $ | 4,525,354 | |

| Liabilities and Equity | | | |

| Liabilities: | | | |

| Accounts payable | $ | 10,814 | | | $ | 6,325 | |

| | | |

| Accrued expenses | 98,902 | | | 131,893 | |

| Income taxes payable | 23,541 | | | 17,912 | |

| Deferred tax liabilities, net | 16,888 | | | 17,051 | |

| Lease liabilities | 48,557 | | | 50,300 | |

| Interest-bearing deposits | 113,259 | | | 115,589 | |

| Borrowings | 2,953,048 | | | 2,914,270 | |

| Other liabilities | 20,855 | | | 32,638 | |

| Total liabilities | 3,285,864 | | | 3,285,978 | |

| | | |

| Equity: | | | |

Preferred stock, $0.01 par value, 2,000 shares authorized, no shares issued and outstanding | — | | | — | |

Common stock, $0.01 par value; 100,000 shares authorized, 39,345 shares issued and outstanding as of March 31, 2024; 100,000 shares authorized, 39,247 shares issued and outstanding as of December 31, 2023 | 393 | | | 392 | |

| Additional paid-in capital | 8,928 | | | 7,071 | |

| Retained earnings | 1,493,023 | | | 1,489,548 | |

| Accumulated other comprehensive loss | (373,018) | | | (329,899) | |

| Total stockholders' equity - PRA Group, Inc. | 1,129,326 | | | 1,167,112 | |

| Noncontrolling interests | 66,992 | | | 72,264 | |

| Total equity | 1,196,318 | | | 1,239,376 | |

| Total liabilities and equity | $ | 4,482,182 | | | $ | 4,525,354 | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

PRA Group, Inc.

Consolidated Income Statements

For the Three Months Ended March 31, 2024 and 2023

(Amounts in thousands, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended March 31, |

| | | | | | 2024 | | 2023 |

| Revenues: | | | | | | | | |

| Portfolio income | | | | | | $ | 202,056 | | | $ | 188,242 | |

| Changes in expected recoveries | | | | | | 51,674 | | | (36,912) | |

| Total portfolio revenue | | | | | | 253,730 | | | 151,330 | |

| Other revenue | | | | | | 1,856 | | | 4,140 | |

| Total revenues | | | | | | 255,586 | | | 155,470 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Compensation and employee services | | | | | | 73,597 | | | 82,403 | |

| Legal collection fees | | | | | | 12,112 | | | 8,838 | |

| Legal collection costs | | | | | | 26,691 | | | 23,945 | |

| Agency fees | | | | | | 19,723 | | | 17,378 | |

| Outside fees and services | | | | | | 25,050 | | | 24,944 | |

| Communication | | | | | | 12,578 | | | 10,527 | |

| Rent and occupancy | | | | | | 4,144 | | | 4,448 | |

| Depreciation and amortization | | | | | | 2,720 | | | 3,589 | |

| | | | | | | | |

| Other operating expenses | | | | | | 12,575 | | | 13,042 | |

| | | | | | | | |

| Total operating expenses | | | | | | 189,190 | | | 189,114 | |

| Income/(loss) from operations | | | | | | 66,396 | | | (33,644) | |

| Other income and (expense): | | | | | | | | |

| | | | | | | | |

| Interest expense, net | | | | | | (52,278) | | | (38,283) | |

| | | | | | | | |

| Foreign exchange gain/(loss), net | | | | | | 227 | | | (9) | |

| Other | | | | | | (206) | | | (650) | |

| Income/(loss) before income taxes | | | | | | 14,139 | | | (72,586) | |

| | | | | | | | |

| Income tax expense/(benefit) | | | | | | 2,386 | | | (18,683) | |

| Net income/(loss) | | | | | | 11,753 | | | (53,903) | |

| Adjustment for net income attributable to noncontrolling interests | | | | | | 8,278 | | | 4,726 | |

| Net income/(loss) attributable to PRA Group, Inc. | | | | | | $ | 3,475 | | | $ | (58,629) | |

| | | | | | | | |

| Net income/(loss) per common share attributable to PRA Group, Inc.: | | | | | | | | |

| Basic | | | | | | $ | 0.09 | | | $ | (1.50) | |

| Diluted | | | | | | $ | 0.09 | | | $ | (1.50) | |

| Weighted average number of shares outstanding: | | | | | | | | |

| Basic | | | | | | 39,274 | | | 39,033 | |

| Diluted | | | | | | 39,448 | | | 39,033 | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

PRA Group, Inc.

Consolidated Statements of Comprehensive Income

For the Three Months Ended March 31, 2024 and 2023

(Amounts in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| | | | | 2024 | | 2023 |

| Net income/(loss) | | | | | $ | 11,753 | | | $ | (53,903) | |

| Other comprehensive loss, net of tax | | | | | | | |

| Foreign currency translation adjustments | | | | | (48,191) | | | (1,550) | |

| Cash flow hedges | | | | | 2,808 | | | (4,831) | |

| Debt securities available-for-sale | | | | | 46 | | | 128 | |

| Other comprehensive loss | | | | | (45,337) | | | (6,253) | |

| Total comprehensive loss | | | | | (33,584) | | | (60,156) | |

| Less comprehensive income attributable to noncontrolling interests | | | | | 6,059 | | | 7,276 | |

| Comprehensive loss attributable to PRA Group, Inc. | | | | | $ | (39,643) | | | $ | (67,432) | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

PRA Group, Inc.

Consolidated Statements of Changes in Equity

For the Three Months Ended March 31, 2024 and 2023

(Amounts in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-In | | Retained | | Accumulated Other Comprehensive | | Noncontrolling | | Total | | |

| Shares | | Amount | | Capital | | Earnings | | Income/(Loss) | | Interests | | Equity | | |

| Balance as of December 31, 2023 | 39,247 | | | $ | 392 | | | $ | 7,071 | | | $ | 1,489,548 | | | $ | (329,899) | | | $ | 72,264 | | | $ | 1,239,376 | | | |

| Components of comprehensive income, net of tax: | | | | | | | | | | | | | | | |

| Net income | — | | | — | | | — | | | 3,475 | | | — | | | 8,278 | | | 11,753 | | | |

| Foreign currency translation adjustments | — | | | — | | | — | | | — | | | (45,973) | | | (2,218) | | | (48,191) | | | |

| Cash flow hedges | — | | | — | | | — | | | — | | | 2,808 | | | — | | | 2,808 | | | |

| Debt securities available-for-sale | — | | | — | | | — | | | — | | | 46 | | | — | | | 46 | | | |

| Distributions to noncontrolling interest | — | | | — | | | — | | | — | | | — | | | (11,332) | | | (11,332) | | | |

| Vesting of restricted stock | 98 | | | 1 | | | (1) | | | — | | | — | | | — | | | — | | | |

| | | | | | | | | | | | | | | |

| Share-based compensation expense | — | | | | | 3,327 | | | — | | | — | | | — | | | 3,327 | | | |

| Employee stock relinquished for payment of taxes | — | | | — | | | (1,469) | | | — | | | — | | | — | | | (1,469) | | | |

| Balance as of March 31, 2024 | 39,345 | | | $ | 393 | | | $ | 8,928 | | | $ | 1,493,023 | | | $ | (373,018) | | | $ | 66,992 | | | $ | 1,196,318 | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional Paid-In | | Retained | | Accumulated Other Comprehensive | | Noncontrolling | | Total | | |

| Shares | | Amount | | Capital | | Earnings | | Income/(Loss) | | Interests | | Equity | | |

| Balance as of December 31, 2022 | 38,980 | | | $ | 390 | | | $ | 2,172 | | | $ | 1,573,025 | | | $ | (347,926) | | | $ | 59,089 | | | $ | 1,286,750 | | | |

| Components of comprehensive income, net of tax: | | | | | | | | | | | | | | | |

| Net loss | — | | | — | | | — | | | (58,629) | | | — | | | 4,726 | | | (53,903) | | | |

| Foreign currency translation adjustments | — | | | — | | | — | | | — | | | (4,101) | | | 2,551 | | | (1,550) | | | |

| Cash flow hedges | — | | | — | | | — | | | — | | | (4,831) | | | — | | | (4,831) | | | |

| Debt securities available-for-sale | — | | | — | | | — | | | — | | | 128 | | | — | | | 128 | | | |

| Vesting of restricted stock | 190 | | | 2 | | | (2) | | | — | | | — | | | — | | | — | | | |

| | | | | | | | | | | | | | | |

| Share-based compensation expense | — | | | — | | | 3,799 | | | — | | | — | | | — | | | 3,799 | | | |

| Employee stock relinquished for payment of taxes | — | | | — | | | (5,684) | | | — | | | — | | | — | | | (5,684) | | | |

| Balance as of March 31, 2023 | 39,170 | | | $ | 392 | | | $ | 285 | | | $ | 1,514,396 | | | $ | (356,730) | | | $ | 66,366 | | | $ | 1,224,709 | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

PRA Group, Inc.

Consolidated Statements of Cash Flows

For the Three Months Ended March 31, 2024 and 2023

(Amounts in thousands)

(unaudited)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income/(loss) | $ | 11,753 | | | $ | (53,903) | |

| Adjustments to reconcile net income/(loss) to net cash used in operating activities: | | | |

| Share-based compensation expense | 3,327 | | | 3,799 | |

| Depreciation and amortization | 2,720 | | | 3,589 | |

| | | |

| | | |

| | | |

| Amortization of debt discount and issuance costs | 2,200 | | | 2,441 | |

| Changes in expected recoveries | (51,674) | | | 36,912 | |

| | | |

| Deferred income taxes | (6,487) | | | (12,400) | |

| Net unrealized foreign currency transaction gain | (9,689) | | | (15,020) | |

| Fair value in earnings for equity securities | 206 | | | (3) | |

| Other | 200 | | | (59) | |

| | | |

| Changes in operating assets and liabilities: | | | |

| Other assets | 1,216 | | | (5,197) | |

| | | |

| Accrued expenses, accounts payable and other liabilities | (26,806) | | | 9,176 | |

| Income taxes payable, net | 66 | | | (16,717) | |

| | | |

| | | |

| Right-of-use asset/lease liability | (31) | | | (139) | |

| | | |

| Net cash used in operating activities | (72,999) | | | (47,521) | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment, net | (495) | | | (405) | |

| | | |

| Purchases of nonperforming loan portfolios | (245,817) | | | (219,030) | |

| Recoveries applied to negative allowance | 251,660 | | | 225,709 | |

| Purchases of investments | (48,247) | | | (60,057) | |

| Proceeds from sales and maturities of investments | 58,110 | | | 62,762 | |

| | | |

| | | |

| | | |

| Net cash provided by investing activities | 15,211 | | | 8,979 | |

| Cash flows from financing activities: | | | |

| Proceeds from lines of credit | 153,171 | | | 243,431 | |

| Principal payments on lines of credit | (86,435) | | | (199,377) | |

| | | |

| | | |

| Proceeds from issuance of Senior Notes due 2028 | — | | | 400,000 | |

| Principal payments on long-term debt | (5,000) | | | (2,500) | |

| | | |

| | | |

| Payments of origination cost and fees | (117) | | | (5,114) | |

| Tax withholdings related to share-based payments | (1,469) | | | (5,683) | |

| Distributions to noncontrolling interests | (11,332) | | | — | |

| | | |

| | | |

| Net increase/(decrease) in interest-bearing deposits | 4,004 | | | (4,951) | |

| | | |

| | | |

| Net cash provided by financing activities | 52,822 | | | 425,806 | |

| Effect of exchange rates on cash | 861 | | | 3,656 | |

| Net increase/(decrease) in cash, cash equivalents and restricted cash | (4,105) | | | 390,920 | |

| Cash, cash equivalents and restricted cash, beginning of period | 113,692 | | | 84,759 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 109,587 | | | $ | 475,679 | |

| Supplemental disclosure of cash flow information: | | | |

| Cash paid for interest | $ | 76,677 | | | $ | 25,081 | |

| Cash paid for income taxes | 8,616 | | | 10,555 | |

| | | |

| | | |

| Reconciliation to Balance Sheet accounts: | | | |

| Cash and cash equivalents | $ | 108,100 | | | $ | 116,471 | |

| Restricted cash included in Other assets | 1,487 | | | 359,208 | |

| Cash, cash equivalents and restricted cash | $ | 109,587 | | | $ | 475,679 | |

The accompanying notes are an integral part of these Consolidated Financial Statements.

PRA Group, Inc.

Notes to Consolidated Financial Statements

1. Organization and Business:

Nature of operations: As used herein, the terms "PRA Group," the "Company," or similar terms refer to PRA Group, Inc. and its subsidiaries.

PRA Group, Inc., a Delaware corporation, is a global financial and business services company with operations in the Americas, Europe and Australia. The Company's primary business is the purchase, collection and management of portfolios of nonperforming loans. The Company also provides fee-based services on class action claims recoveries in the United States ("U.S.").

Basis of presentation: The Consolidated Financial Statements of the Company are prepared in accordance with U.S. generally accepted accounting principles ("GAAP"). The accompanying interim financial statements have been prepared in accordance with the instructions for Quarterly Reports on Form 10-Q, and therefore, do not include all information and Notes to the Consolidated Financial Statements necessary for a complete presentation of financial position, results of operations, comprehensive income/(loss) and cash flows in conformity with GAAP. In the opinion of management, all adjustments, consisting of normal and recurring items, necessary for the fair presentation of the Company's Consolidated Balance Sheets as of March 31, 2024, and the Consolidated Income Statements, Statements of Comprehensive Income, Statements of Changes in Equity and Statements of Cash Flows for the three months ended March 31, 2024 and 2023, have been included. The Consolidated Financial Statements include the accounts of PRA Group and other entities in which the Company has a controlling interest. All significant intercompany accounts and transactions have been eliminated.

These unaudited Consolidated Financial Statements should be read in conjunction with the audited Consolidated Financial Statements and notes thereto included in the Company's Annual Report on Form 10-K for the year ended December 31, 2023 (the "2023 Form 10-K"). For further discussion of the Company's significant accounting policies, refer to Note 1 to the Consolidated Financial Statements in the 2023 Form 10-K. There were no material changes to these policies during the three months ended March 31, 2024.

The preparation of the Consolidated Financial Statements in conformity with GAAP requires management to make estimates and assumptions that affect reported amounts and disclosures. Realized results could differ from those estimates and assumptions, and the Company's Consolidated Income Statements for the three months ended March 31, 2024 may not be indicative of future results.

Reclassification of prior year presentation: Certain prior period amounts have been reclassified for consistency with the current period presentation. In the Consolidated Statements of Cash Flows, changes in Accrued expenses, Accounts payable and Other liabilities are now presented as a single line-item within Changes in operating assets and liabilities.

2. Finance Receivables, net:

Finance receivables, net consisted of the following as of March 31, 2024 and December 31, 2023 (amounts in thousands):

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| Amortized cost | $ | — | | | $ | — | |

| Negative allowance for expected recoveries | 3,650,195 | | | 3,656,598 | |

| Balance at end of period | $ | 3,650,195 | | | $ | 3,656,598 | |

PRA Group, Inc.

Notes to Consolidated Financial Statements

Changes in the negative allowance for expected recoveries by portfolio segment for the three months ended March 31, 2024 and 2023 were as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 |

| Core | | Insolvency | | Total |

| Balance at beginning of period | $ | 3,295,214 | | | $ | 361,384 | | | $ | 3,656,598 | |

Initial negative allowance for expected recoveries - portfolio acquisitions (1) | 218,657 | | | 27,160 | | | 245,817 | |

| Foreign currency translation adjustment | (50,127) | | | (2,107) | | | (52,234) | |

Recoveries applied to negative allowance (2) | (215,216) | | | (36,444) | | | (251,660) | |

Changes in expected recoveries (3) | 49,564 | | | 2,110 | | | 51,674 | |

| Balance at end of period | $ | 3,298,092 | | | $ | 352,103 | | | $ | 3,650,195 | |

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2023 |

| Core | | Insolvency | | Total |

| Balance at beginning of period | $ | 2,936,207 | | | $ | 358,801 | | | $ | 3,295,008 | |

Initial negative allowance for expected recoveries - portfolio acquisitions (1) | 207,322 | | | 22,903 | | | 230,225 | |

| Foreign currency translation adjustment | 19,835 | | | 4,050 | | | 23,885 | |

Recoveries applied to negative allowance (2) | (186,386) | | | (39,323) | | | (225,709) | |

Changes in expected recoveries (3) | (41,128) | | | 4,216 | | | (36,912) | |

| Balance at end of period | $ | 2,935,850 | | | $ | 350,647 | | | $ | 3,286,497 | |

(1) Initial negative allowance for expected recoveries - portfolio acquisitions

Portfolio acquisitions for the three months ended March 31, 2024 and 2023 were as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 |

| Core | | Insolvency | | Total |

| Face value | $ | 1,708,631 | | | $ | 114,216 | | | $ | 1,822,847 | |

| Noncredit discount | (231,385) | | | (13,442) | | | (244,827) | |

| Allowance for credit losses at acquisition | (1,258,589) | | | (73,614) | | | (1,332,203) | |

| Purchase price | $ | 218,657 | | | $ | 27,160 | | | $ | 245,817 | |

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2023 |

| Core | | Insolvency | | Total |

| Face value | $ | 1,507,965 | | | $ | 104,809 | | | $ | 1,612,774 | |

| Noncredit discount | (150,511) | | | (8,042) | | | (158,553) | |

| Allowance for credit losses at acquisition | (1,150,132) | | | (73,864) | | | (1,223,996) | |

| Purchase price | $ | 207,322 | | | $ | 22,903 | | | $ | 230,225 | |

The initial negative allowance recorded on portfolio acquisitions for the three months ended March 31, 2024 and 2023 was as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 |

| Core | | Insolvency | | Total |

| Allowance for credit losses at acquisition | $ | (1,258,589) | | | $ | (73,614) | | | $ | (1,332,203) | |

| Writeoffs, net | 1,258,589 | | | 73,614 | | | 1,332,203 | |

| Expected recoveries | 218,657 | | | 27,160 | | | 245,817 | |

| Initial negative allowance for expected recoveries | $ | 218,657 | | | $ | 27,160 | | | $ | 245,817 | |

PRA Group, Inc.

Notes to Consolidated Financial Statements

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2023 |

| Core | | Insolvency | | Total |

| Allowance for credit losses at acquisition | $ | (1,150,132) | | | $ | (73,864) | | | $ | (1,223,996) | |

| Writeoffs, net | 1,150,132 | | | 73,864 | | | 1,223,996 | |

| Expected recoveries | 207,322 | | | 22,903 | | | 230,225 | |

| Initial negative allowance for expected recoveries | $ | 207,322 | | | $ | 22,903 | | | $ | 230,225 | |

(2) Recoveries applied to negative allowance

Recoveries applied to the negative allowance for the three months ended March 31, 2024 and 2023 were as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 |

| Core | | Insolvency | | Total |

Recoveries (a) | $ | 406,313 | | | $ | 47,403 | | | $ | 453,716 | |

| Less - amounts reclassified to portfolio income | 191,097 | | | 10,959 | | | 202,056 | |

| Recoveries applied to negative allowance | $ | 215,216 | | | $ | 36,444 | | | $ | 251,660 | |

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2023 |

| Core | | Insolvency | | Total |

Recoveries (a) | $ | 364,236 | | | $ | 49,715 | | | $ | 413,951 | |

| Less - amounts reclassified to portfolio income | 177,850 | | | 10,392 | | | 188,242 | |

| Recoveries applied to negative allowance | $ | 186,386 | | | $ | 39,323 | | | $ | 225,709 | |

(a) Recoveries include cash collections, buybacks and other cash-based adjustments.

(3) Changes in expected recoveries

Changes in expected recoveries for the three months ended March 31, 2024 and 2023 were as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 |

| Core | | Insolvency | | Total |

| Changes in expected future recoveries | $ | 15,646 | | | $ | 190 | | | $ | 15,836 | |

| Recoveries received in excess of forecast | 33,919 | | | 1,919 | | | 35,838 | |

| Changes in expected recoveries | $ | 49,565 | | | $ | 2,109 | | | $ | 51,674 | |

| | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2023 |

| Core | | Insolvency | | Total |

| Changes in expected future recoveries | $ | (41,414) | | | $ | 664 | | | $ | (40,750) | |

| Recoveries received in excess of forecast | 286 | | | 3,552 | | | 3,838 | |

| Changes in expected recoveries | $ | (41,128) | | | $ | 4,216 | | | $ | (36,912) | |

In order to estimate future cash collections, the Company considers factors such as historical collections performance and its view of economic conditions and consumer habits in the various geographies in which the Company operates. Based on these considerations, adjustments to estimated remaining collections ("ERC") may incorporate changes in both the amounts and the timing of expected cash collections over the forecast period.

Changes in expected recoveries for the three months ended March 31, 2024 were $51.7 million. This was primarily due to $35.8 million in recoveries received in excess of forecast (cash collections overperformance), due largely to collections performance in the U.S., driven by the impact of the Company's cash-generating initiatives and supplemented by tax refund seasonality, as well as collections performance in Brazil and Europe. The changes in expected future recoveries of $15.8 million reflect the Company's assessment of certain pools in Europe, Brazil and the U.S., resulting in increases to the expected cash flows.

PRA Group, Inc.

Notes to Consolidated Financial Statements

Changes in expected recoveries for the three months ended March 31, 2023 were a net negative $36.9 million. This included $3.8 million in recoveries received in excess of forecast (cash collections overperformance) and a $40.8 million negative adjustment to changes in expected future recoveries. Overperformance decreased by $19.8 million as a result of reduced cash collections primarily in the U.S. due to a slower tax season. The changes in expected future recoveries reflected the Company's assessment of certain pools resulting in a reduction of expected cash flows as a result of slowing collection performance in the U.S. call centers resulting from weak economic conditions.

3. Investments:

Investments consisted of the following as of March 31, 2024 and December 31, 2023 (amounts in thousands):

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| | | |

| | | |

| Debt securities | | | |

| | | |

| | | |

| | | |

| Available-for-sale | $ | 47,149 | | | $ | 59,470 | |

| | | |

| | | |

| Equity securities | | | |

| Private equity funds | 2,243 | | | 2,451 | |

| Equity method investment | 9,487 | | | 10,483 | |

| | | |

| Total investments | $ | 58,879 | | | $ | 72,404 | |

Debt Securities

Government securities: As of March 31, 2024, the Company's available-for-sale debt securities consisted of Swedish treasury securities, all of which mature within one year. As of March 31, 2024 and December 31, 2023, the amortized cost and fair value of these investments were as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2024 |

| Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Aggregate Fair Value |

| Available-for-sale | | | | | | | |

| | | | | | | |

| | | | | | | |

| Government securities | $ | 47,037 | | | $ | 112 | | | $ | — | | | $ | 47,149 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| December 31, 2023 |

| Amortized Cost | | Gross Unrealized Gains | | Gross Unrealized Losses | | Aggregate Fair Value |

| Available-for-sale | | | | | | | |

| | | | | | | |

| Government securities | $ | 59,404 | | | $ | 66 | | | $ | — | | | $ | 59,470 | |

| | | | | | | |

| | | | | | | |

Equity Method Investment

The Company has an 11.7% interest in RCB Investimentos S.A. ("RCB"), a servicing platform for nonperforming loans in Brazil, accounted for under the equity method.

4. Goodwill:

The Company performs an annual review of goodwill as of October 1 of each year, or more frequently if indicators of impairment exist, with the most recent annual review performed as of October 1, 2023. The Company performed a quarterly assessment by evaluating whether any triggering events had occurred as of March 31, 2024, which included considering current market conditions, and determined that goodwill was not more-likely-than-not impaired. Changes in goodwill for the three months ended March 31, 2024 and 2023, were as follows (amounts in thousands):

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Balance as of beginning of period | $ | 431,564 | | | $ | 435,921 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Foreign currency translation | (19,718) | | | (15,274) | | | | | |

| Balance as of end of period | $ | 411,846 | | | $ | 420,647 | | | | | |

PRA Group, Inc.

Notes to Consolidated Financial Statements

5. Borrowings:

Borrowings consisted of the following as of March 31, 2024 and December 31, 2023 (amounts in thousands):

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

North American revolving credit facility (1) | $ | 504,180 | | | $ | 396,303 | |

United Kingdom revolving credit facility (2) | 487,065 | | | 502,847 | |

European revolving credit facility (3) | 489,391 | | | 538,565 | |

North American term loan (4) | 437,500 | | | 442,500 | |

Senior notes (5) | 1,046,000 | | | 1,046,000 | |

| | | |

| Total gross borrowings | 2,964,136 | | | 2,926,215 | |

| Less: Debt discount and issuance costs | (11,088) | | | (11,945) | |

| Borrowings | $ | 2,953,048 | | | $ | 2,914,270 | |

(1)Revolving credit facility under the Company's North American Revolving Credit and Term Loan (the "North American Credit Agreement"), which includes an aggregate principal amount of $1.5 billion (subject to compliance with a borrowing base and applicable debt covenants), consisting of (i) a fully-funded $437.5 million term loan (the "Term Loan"), (ii) a $1.0 billion domestic revolving credit facility, and (iii) a $75.0 million Canadian revolving credit facility, maturing on July 30, 2026.

(2)Revolving credit facility under the Company's United Kingdom ("UK") Credit Agreement (the "UK Credit Agreement"), consisting of an $800.0 million revolving credit facility (subject to a borrowing base), and an accordion feature for up to $200.0 million in additional commitments, subject to certain conditions, maturing on July 30, 2026.

(3)Revolving credit facility under the Company's European Credit Agreement (the "European Credit Agreement"), providing revolving borrowings for an aggregate amount of approximately €730.0 million (subject to the borrowing base and applicable debt covenants), and an accordion feature for up to €500.0 million, subject to certain conditions, maturing on November 23, 2027. During the three months ended March 31, 2024, the lenders under the European Credit Agreement consented to an increase in the limit for interest bearing deposits in AK Nordic AB from SEK1.2 billion to SEK2.2 billion.

(4)Term Loan under the North American Credit Agreement.

(5)Comprised of the Senior Notes due 2025 (the "2025 Notes"), Senior Notes due 2028 (the "2028 Notes") and the Senior Notes due 2029 (the "2029 Notes" and, together with the 2025 Notes and 2028 Notes, the "Senior Notes"), with outstanding principal balances of $298.0 million, $398.0 million and $350.0 million, respectively, as of March 31, 2024 and December 31, 2023.

For additional details about the Company's credit facilities, Term Loan and Senior Notes, refer to Note 7 to the Consolidated Financial Statements in the 2023 Form 10-K. The Company determined that it was in compliance with the covenants contained in its financing arrangements as of March 31, 2024.

6. Derivatives:

The Company periodically enters into derivative financial instruments; typically interest rate swaps and foreign currency contracts, to reduce its exposure to fluctuations in interest rates on variable-rate debt and foreign currency exchange rates. Derivative financial instruments are recognized at fair value in the Company's Consolidated Balance Sheets. For further discussion of the Company's use of, and accounting policies for, derivative instruments, refer to Notes 1 and 8 to the Consolidated Financial Statements in the 2023 Form 10-K. The following table summarizes the fair value of derivative financial instruments as of March 31, 2024 and December 31, 2023 (amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | March 31, 2024 | | December 31, 2023 |

| | Balance Sheet Account | | Fair Value | | Balance Sheet Account | | Fair Value |

| Derivatives designated as hedging instruments: | | | | | | | | |

| Interest rate contracts | | Other assets | | $ | 20,999 | | | Other assets | | $ | 21,770 | |

| Interest rate contracts | | Other liabilities | | 7,071 | | | Other liabilities | | 11,627 | |

| Derivatives not designated as hedging instruments: | | | | | | | | |

| Foreign currency contracts | | Other assets | | 968 | | | Other assets | | 1,007 | |

| Foreign currency contracts | | Other liabilities | | 1,375 | | | Other liabilities | | 8,776 | |

| | | | | | | | |

| | | | | | | | |

Derivatives Designated as Hedging Instruments:

Changes in the fair value of derivative contracts designated as cash flow hedging instruments are recognized in other comprehensive income ("OCI"). As of March 31, 2024 and December 31, 2023, the notional amount of interest rate contracts designated as cash flow hedging instruments was $812.9 million and $872.3 million, respectively. Derivatives designated as

PRA Group, Inc.

Notes to Consolidated Financial Statements

cash flow hedging instruments remained highly effective as of March 31, 2024, and have remaining terms from eight months to four years. As of March 31, 2024, the Company estimates that $12.8 million of net derivative gains included in OCI will be reclassified into earnings within the next 12 months.

The following tables summarize the effects of derivatives designated as cash flow hedging instruments for the three months ended March 31, 2024 and 2023 (amounts in thousands):

| | | | | | | | | | | | | | | | | | |

| | Gain/(loss) recognized in OCI, net of tax |

| | Three Months Ended March 31, | | |

| Hedging instrument | | 2024 | | 2023 | | | | |

| Interest rate contracts | | $ | 7,070 | | | $ | (629) | | | | | |

| | | | | | | | |

| | Gain/(loss) reclassified from OCI into income |

| | Three Months Ended March 31, | | |

| Income statement account | | 2024 | | 2023 | | | | |

| Interest expense, net | | $ | 5,674 | | | $ | (5,498) | | | | | |

Derivatives Not Designated as Hedging Instruments:

The Company enters into foreign currency contracts to economically hedge foreign currency remeasurement exposure related to certain balances denominated in currencies other than the functional currency of the Company or its international subsidiaries. Changes in fair value of derivative contracts not designated as hedging instruments are recognized in earnings. As of March 31, 2024 and December 31, 2023, the notional amount of foreign currency contracts was $307.4 million and $368.5 million, respectively.

The following table summarizes the effects of derivatives not designated as hedging instruments for the three months ended March 31, 2024 and 2023 (amounts in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | | | Gain/(loss) recognized in income |

| | | | Three Months Ended March 31, |

| Derivatives not designated as hedging instruments | | Income statement account | | 2024 | | 2023 |

| Foreign currency contracts | | Foreign exchange gain/(loss), net | | $ | 100 | | | $ | (7,697) | |

| Foreign currency contracts | | Interest expense, net | | 192 | | | 521 | |

| | | | | | |

| | | | | | |

| | | | |

| | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

7. Fair Value:

As defined by ASC Topic 820, "Fair Value Measurement and Disclosures" ("ASC 820"), fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. ASC 820 requires the consideration of different input levels in the determination of fair value, as follows:

•Level 1: Quoted prices in active markets for identical assets and liabilities.

•Level 2: Observable inputs other than Level 1 quoted prices, such as quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active, and model-based valuation techniques for which all significant assumptions are observable in the market.

•Level 3: Unobservable inputs that are supported by little or no market activity. Level 3 assets and liabilities include financial instruments whose value is determined using pricing models, discounted cash flow methodologies, or similar techniques, as well as instruments for which the determination of fair value requires significant management judgment or estimation.

The level in the fair value hierarchy within which a fair value measurement in its entirety falls is based on the lowest level input that is significant to the fair value measurement in its entirety.

PRA Group, Inc.

Notes to Consolidated Financial Statements

Financial Instruments Not Carried at Fair Value

As of March 31, 2024 and December 31, 2023, the carrying amounts and estimated fair values of financial instruments not carried at fair value were as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| Carrying

Amount | | Estimated

Fair Value | | Carrying

Amount | | Estimated

Fair Value |

| Financial assets: | | | | | | | |

| Cash and cash equivalents | $ | 108,100 | | | $ | 108,100 | | | $ | 112,528 | | | $ | 112,528 | |

| | | | | | | |

| | | | | | | |

| Finance receivables, net | 3,650,195 | | | 3,172,948 | | | 3,656,598 | | | 3,167,798 | |

| Financial liabilities: | | | | | | | |

| Interest-bearing deposits | 113,259 | | | 113,259 | | | 115,589 | | | 115,589 | |

| Revolving lines of credit | 1,480,636 | | | 1,480,636 | | | 1,437,715 | | | 1,437,715 | |

Term Loan (1) | 437,500 | | | 437,500 | | | 442,500 | | | 442,500 | |

Senior Notes (1) | 1,046,000 | | | 988,926 | | | 1,046,000 | | | 964,907 | |

| | | | | | | |

(1)Carrying amounts and estimated fair values do not include debt issuance costs.

The Company uses the following methods and assumptions to estimate the fair value of the above financial instruments:

Cash equivalents: Carrying amount approximates fair value due to the short-term nature of the instruments and the observable quoted prices for identical assets in active markets. Accordingly, the Company uses Level 1 inputs.

Finance receivables, net: The Company estimates the fair value of these receivables using proprietary pricing models that the Company utilizes to make portfolio acquisition decisions. Accordingly, the Company's fair value estimates use Level 3 inputs as there is little observable market data available and management is required to use significant judgment in its estimates.

Interest-bearing deposits: Carrying amount approximates fair value due to the short-term nature of the deposits and the observable quoted prices for similar instruments in active markets. Accordingly, the Company uses Level 2 inputs for its fair value estimates.

Revolving lines of credit: Carrying amount approximates fair value due to the short-term nature of the interest rate periods and the observable quoted prices for similar instruments in active markets. Accordingly, the Company uses Level 2 inputs for its fair value estimate.

Term loan: Carrying amount approximates fair value due to the short-term nature of the interest rate periods and the observable quoted prices for similar instruments in active markets. Accordingly, the Company uses Level 2 inputs for its fair value estimate.

Senior Notes: Fair value estimates for the Senior Notes incorporate quoted market prices obtained from secondary market broker quotes, which were derived from a variety of inputs, including client orders, information from their pricing vendors, modeling software and actual trading prices when they occur. Accordingly, the Company uses Level 2 inputs for its fair value estimates.

PRA Group, Inc.

Notes to Consolidated Financial Statements

Financial Instruments Carried at Fair Value

As of March 31, 2024 and December 31, 2023, financial instruments measured at fair value on a recurring basis were as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Fair Value Measurements as of March 31, 2024 |

| Level 1 | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | |

| | | | | | | |

| Government securities | $ | 47,149 | | | $ | — | | | $ | — | | | $ | 47,149 | |

| | | | | | | |

| | | | | | | |

| Derivative contracts (recorded in Other assets) | — | | | 21,967 | | | — | | | 21,967 | |

| Liabilities: | | | | | | | |

| Derivative contracts (recorded in Other liabilities) | — | | | 8,446 | | | — | | | 8,446 | |

| | | | | | | |

| Fair Value Measurements as of December 31, 2023 |

| Level 1 | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | |

| | | | | | | |

| Government securities | $ | 59,470 | | | $ | — | | | $ | — | | | $ | 59,470 | |

| | | | | | | |

| | | | | | | |

| Derivative contracts (recorded in Other assets) | — | | | 22,777 | | | — | | | 22,777 | |

| Liabilities: | | | | | | | |

| Derivative contracts (recorded in Other liabilities) | — | | | 20,403 | | | — | | | 20,403 | |

The Company uses the following methods and assumptions to estimate the fair value of the above financial instruments:

Government securities: Fair value of the Company's investments in government securities is estimated using quoted market prices. Accordingly, the Company uses Level 1 inputs.

Derivative contracts: Fair value of derivative contracts is estimated using industry standard valuation models. These models project future cash flows and discount the future amounts to present value using market-based observable inputs, including interest rate curves and other factors. Accordingly, the Company uses Level 2 inputs for its fair value estimates.

8. Accumulated Other Comprehensive Loss:

Reclassifications out of Accumulated other comprehensive loss for the three months ended March 31, 2024 and 2023, were as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | | | |

| Gain on cash flow hedges | | 2024 | | 2023 | | | | | | Income Statement Account |

| Interest rate swaps | | $ | 5,674 | | | $ | 5,498 | | | | | | | Interest expense, net |

Income tax effect of item above (1) | | (1,413) | | | (1,296) | | | | | | | Income tax expense/(benefit) |

| Total gain on cash flow hedges | | $ | 4,261 | | | $ | 4,202 | | | | | | | |

| | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

(1)Income tax effects are released from Accumulated other comprehensive loss contemporaneously with the related gross pretax amount.

PRA Group, Inc.

Notes to Consolidated Financial Statements

Changes in Accumulated other comprehensive loss by component, after tax, for the three months ended March 31, 2024 and 2023, were as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2024 |

| | Debt Securities | | Cash Flow | | Currency Translation | | Accumulated Other |

| | Available-for-sale | | Hedges | | Adjustments | | Comprehensive Loss (1) |

| Balance as of beginning of period | | $ | 65 | | | $ | 6,597 | | | $ | (336,561) | | | $ | (329,899) | |

| Other comprehensive gain/(loss) before reclassifications | | 46 | | | 7,070 | | | (45,973) | | | (38,857) | |

| Reclassifications, net | | — | | | (4,262) | | | — | | | (4,262) | |

| Net current period other comprehensive gain/(loss) | | 46 | | | 2,808 | | | (45,973) | | | (43,119) | |

| Balance as of end of period | | $ | 111 | | | $ | 9,405 | | | $ | (382,534) | | | $ | (373,018) | |

| | | | | | | | |

| | Three Months Ended March 31, 2023 |

| | Debt Securities | | Cash Flow | | Currency Translation | | Accumulated Other |

| | Available-for-sale | | Hedges | | Adjustments | | Comprehensive Loss (1) |

| Balance as of beginning of period | | $ | (237) | | | $ | 27,804 | | | $ | (375,493) | | | $ | (347,926) | |

| Other comprehensive gain/(loss) before reclassifications | | 128 | | | (629) | | | (4,101) | | | (4,602) | |

| Reclassifications, net | | — | | | (4,202) | | | — | | | (4,202) | |

| Net current period other comprehensive gain/(loss) | | 128 | | | (4,831) | | | (4,101) | | | (8,804) | |

| Balance as of end of period | | $ | (109) | | | $ | 22,973 | | | $ | (379,594) | | | $ | (356,730) | |

(1) Net of deferred taxes for unrealized (gains)/losses from cash flow hedges of $(3.1) million and $(7.6) million for the three months ended March 31, 2024 and 2023, respectively.

9. Earnings per Share:

Basic earnings per share ("EPS") are computed by dividing net income available to common stockholders of PRA Group, Inc. by weighted average common shares outstanding. Diluted EPS are computed using the same components as basic EPS, with the denominator adjusted for nonvested share awards, if dilutive. Share-based awards that are contingent upon the attainment of performance goals are included in the computation of diluted EPS if the effect is dilutive. The dilutive effect of nonvested shares is computed using the treasury stock method, which assumes any proceeds that could be obtained upon the vesting of nonvested shares would be used to purchase common shares at the average market price for the period.

The following table provides a reconciliation between the computation of basic and diluted EPS for the three months ended March 31, 2024 and 2023 (amounts in thousands, except per share amounts):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Net Income Attributable to PRA Group, Inc. | | Weighted

Average

Common Shares | | EPS | | Net Loss Attributable to PRA Group, Inc. | | Weighted

Average

Common Shares | | EPS |

| Basic EPS | $ | 3,475 | | | 39,274 | | | $ | 0.09 | | | $ | (58,629) | | | 39,033 | | | $ | (1.50) | |

| Dilutive effect of nonvested share awards | — | | | 174 | | | — | | | — | | | — | | | — | |

| | | | | | | | | | | |

| Diluted EPS | $ | 3,475 | | | 39,448 | | | $ | 0.09 | | | $ | (58,629) | | | 39,033 | | | $ | (1.50) | |

| | | | | | | | | | | |

| |

| | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

PRA Group, Inc.

Notes to Consolidated Financial Statements

10. Commitments and Contingencies:

Forward Flow Agreements:

The Company enters into forward flow agreements for the purchase of nonperforming loans. These agreements typically have terms ranging from six to 12 months, or they can be open-ended, and establish purchase prices and specific criteria for the accounts to be purchased. Some of the agreements establish a volume reference for the contract term in the form of a target or maximum, however, very few agreements establish a minimum contractual obligation, and many of the contracts contain early termination provisions allowing either party to cancel the agreements in accordance with a specified notice period. The amounts purchased are also dependent on actual delivery by the sellers, and while purchases under these agreements comprise a significant portion of the Company's overall purchases, as of March 31, 2024, the minimum purchase obligation under these forward flow agreements was not significant.

Litigation and Regulatory Matters:

The Company and its subsidiaries are from time-to-time subject to a variety of legal and regulatory claims, inquiries and proceedings and regulatory matters, most of which are incidental to the ordinary course of its business. The Company initiates lawsuits against customers and is occasionally countersued by them in such actions. Also, customers, either individually, as members of a class action, or through a governmental entity on behalf of customers, may initiate litigation against the Company in which they allege that the Company has violated a law in the process of collecting on an account. From time-to-time, other types of lawsuits are brought against the Company. Additionally, the Company receives subpoenas and other requests or demands for information from regulators or governmental authorities who are investigating the Company's debt collection activities.

The Company accrues for potential liability arising from legal proceedings and regulatory matters when it is probable that such liability has been incurred and the amount of the loss can be reasonably estimated. This determination is based upon currently available information for those proceedings in which the Company is involved, taking into account the Company's best estimate of such losses for those cases for which such estimates can be made. The Company's estimate involves significant judgment, given the varying stages of the proceedings (including the fact that many of them are currently in preliminary stages), the number of unresolved issues in many of the proceedings (including issues regarding class certification and the scope of many of the claims), and the related uncertainty of the potential outcomes of these proceedings. In making determinations of the likely outcome of pending litigation, the Company considers many factors, including, but not limited to, the nature of the claim, the Company's experience with similar types of claims, the jurisdiction in which the matter is filed, input from outside legal counsel, the likelihood of resolving the matter through alternative mechanisms, the matter's current status and the damages sought or demands made. Accordingly, the Company's estimate will change from time to time, and actual losses could exceed the current estimate.

In certain legal proceedings, the Company may have recourse to insurance or third-party contractual indemnities to cover all or portions of its litigation expenses, judgments, or settlements. Loss estimates and accruals for potential liability related to legal proceedings are typically exclusive of potential recoveries, if any, under the Company's insurance policies or third-party indemnities.

The Company believes that the estimate of the aggregate range of reasonably possible losses in excess of the amount accrued for its legal proceedings outstanding as of March 31, 2024, where the range of loss can be estimated, was not material. As of March 31, 2024, there were no material developments in any of the legal proceedings included in Note 14 to the Consolidated Financial Statements in the 2023 Form 10-K, and there were no new material legal proceedings during the three months ended March 31, 2024.

11. Recently Issued Accounting Standards:

Recently issued accounting standards not yet adopted:

The Company does not expect that any recently issued accounting pronouncements will have a material effect on its Consolidated Financial Statements.

Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations

All references in this Quarterly Report on Form 10-Q ("Quarterly Report") to "PRA Group," "we," "our," "us," "the Company" or similar terms are to PRA Group, Inc. and its subsidiaries.

Forward-Looking Statements:

This Quarterly Report contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. Statements other than statements of historical fact are forward-looking statements, including statements regarding cash collection trends, operating cost trends, liquidity and capital needs and other statements of expectations, beliefs, future plans, strategies and anticipated events or trends. Our results could differ materially from those expressed or implied by such forward-looking statements, or our forward-looking statements could be wrong, as a result of risks, uncertainties and assumptions, including the following:

•a deterioration in the economic or inflationary environment in the markets in which we operate;

•our ability to replace our portfolios of nonperforming loans with additional portfolios sufficient to operate efficiently and profitably and/or purchase nonperforming loans at appropriate prices;

•our ability to collect sufficient amounts on our nonperforming loans to fund our operations, including as a result of restrictions imposed by local, state, federal and international laws and regulations;

•a disruption or failure by any of our outsourcing or offshoring third party service providers to meet their obligations and our service level expectations;

•our ability to successfully implement our strategic and operational initiatives in our U.S. business;

•changes in accounting standards and their interpretations;

•the impact of a disease outbreak on the markets in which we operate and our inability to successfully manage the challenges associated with a disease outbreak, including epidemics, pandemics or similar widespread public health concerns;

•the occurrence of goodwill impairment charges;

•loss contingency accruals that are inadequate to cover actual losses;

•our ability to manage risks associated with our international operations;

•changes in local, state, federal or international laws or the interpretation of these laws, including tax, bankruptcy and collection laws;

•our ability to comply with existing and new regulations of the collection industry;

•changes in tax provisions or exposure to additional tax liabilities;

•investigations, reviews, or enforcement actions by governmental authorities, including the Consumer Financial Protection Bureau ("CFPB");

•our ability to comply with data privacy regulations such as the General Data Protection Regulation ("GDPR");

•adverse outcomes in pending litigation or administrative proceedings;

•our ability to retain, expand, renegotiate or replace our credit facilities and our inability to comply with the covenants under our financing arrangements;

•our ability to manage effectively our capital and liquidity needs, including as a result of changes in credit or capital markets or adverse changes in our credit ratings, whether due to concerns about our industry in general, the financial condition of our competitors, or other factors;

•changes in interest or exchange rates;

•default by or failure of one or more of our counterparty financial institutions;

•disruptions of business operations caused by cybersecurity incidents or the underperformance or failure of information technology infrastructure, networks or communication systems; and

•the "Risk Factors" in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2023 ("2023 Form 10-K") and in other filings with the Securities and Exchange Commission.

You should assume that the information appearing in this Quarterly Report is accurate only as of the date it was issued. Our business, financial condition, results of operations and prospects may have changed since that date. The future events, developments or results described in, or implied by, this Quarterly Report could turn out to be materially different. Except as required by law, we assume no obligation to publicly update or revise our forward-looking statements after the date of this Quarterly Report and you should not expect us to do so.

Frequently Used Terms

We may use the following terminology throughout this Quarterly Report:

•"Buybacks" refers to purchase price refunded by the seller due to the return of ineligible nonperforming loan accounts.

•"Cash collections" refers to collections on our nonperforming loan portfolios.

•"Cash receipts" refers to cash collections on our nonperforming loan portfolios, fees and revenue recognized from our class action claims recovery services.

•"Change in expected recoveries" refers to the differences of actual recoveries received when compared to expected recoveries and the net present value of changes in estimated remaining collections.

•"Core" accounts or portfolios refer to accounts or portfolios that are nonperforming loans and are not in an insolvent status upon acquisition. These accounts are aggregated separately from insolvency accounts.

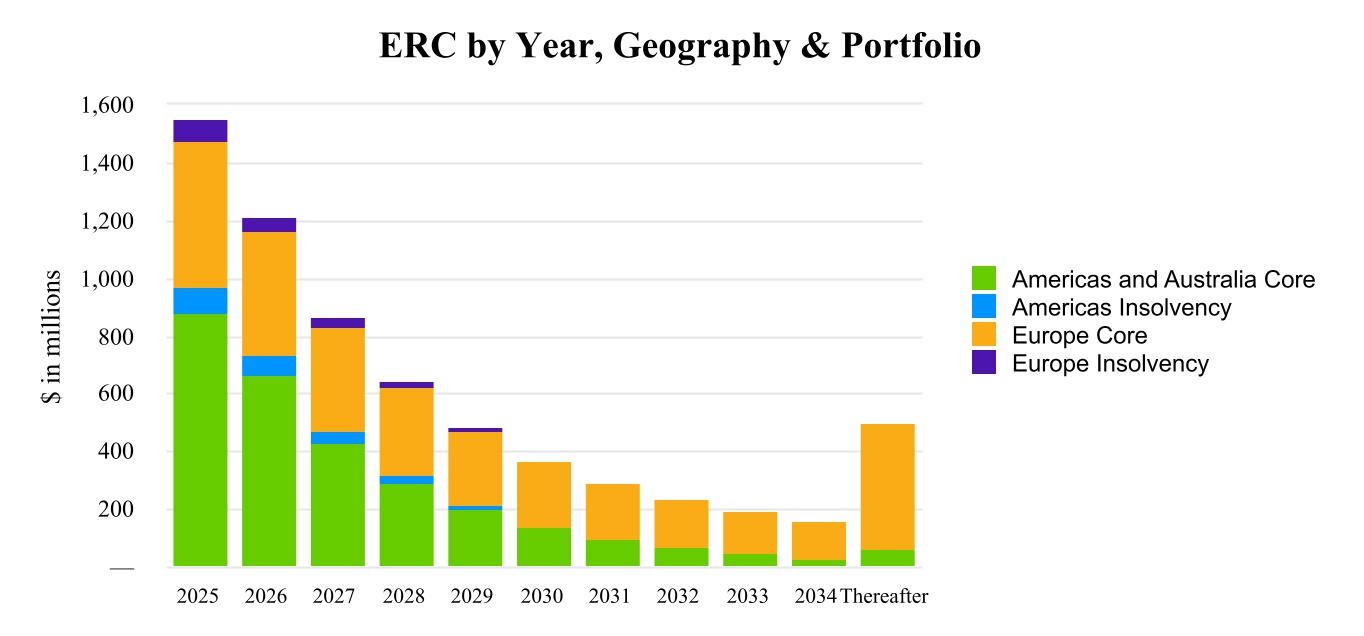

•"Estimated remaining collections" or "ERC" refers to the sum of all future projected cash collections on our nonperforming loan portfolios.

•"Finance receivables" or "receivables" refers to the negative allowance for expected recoveries recorded on our balance sheet as an asset.

•"Insolvency" accounts or portfolios refer to accounts or portfolios of nonperforming loans that are in an insolvent status when we purchase them and as such are purchased as a pool of insolvent accounts. These accounts include Individual Voluntary Arrangements ("IVAs"), Trust Deeds in the UK, Consumer Proposals in Canada and bankruptcy accounts in the U.S., Canada, Germany and the UK.

•"Negative allowance" refers to the present value of cash flows expected to be collected on our finance receivables.

•"Portfolio acquisitions" refers to all nonperforming loan portfolios acquired as a result of a purchase or added as a result of a business acquisition.

•"Portfolio purchases" refers to all nonperforming loan portfolios purchased in the normal course of business and excludes those added as a result of business acquisitions.

•"Portfolio income" reflects revenue recorded due to the passage of time using the effective interest rate calculated based on the purchase price of nonperforming loan portfolios and estimated remaining collections.

•"Purchase price" refers to the cash paid to a seller to acquire nonperforming loans.

•"Purchase price multiple" refers to the total estimated collections on our nonperforming loan portfolios divided by purchase price.

•"Recoveries" refers to cash collections plus buybacks and other adjustments.

•"Total estimated collections" or "TEC" refers to actual cash collections plus estimated remaining collections on our nonperforming loan portfolios.

Executive Overview

We are a global financial and business services company with operations in the Americas, Europe and Australia. Our primary business is the purchase, collection and management of portfolios of nonperforming loans. We are headquartered in Norfolk, Virginia, and our shares of common stock are traded on the Nasdaq Global Select Market under the symbol "PRAA".

For the first quarter of 2024, we generated:

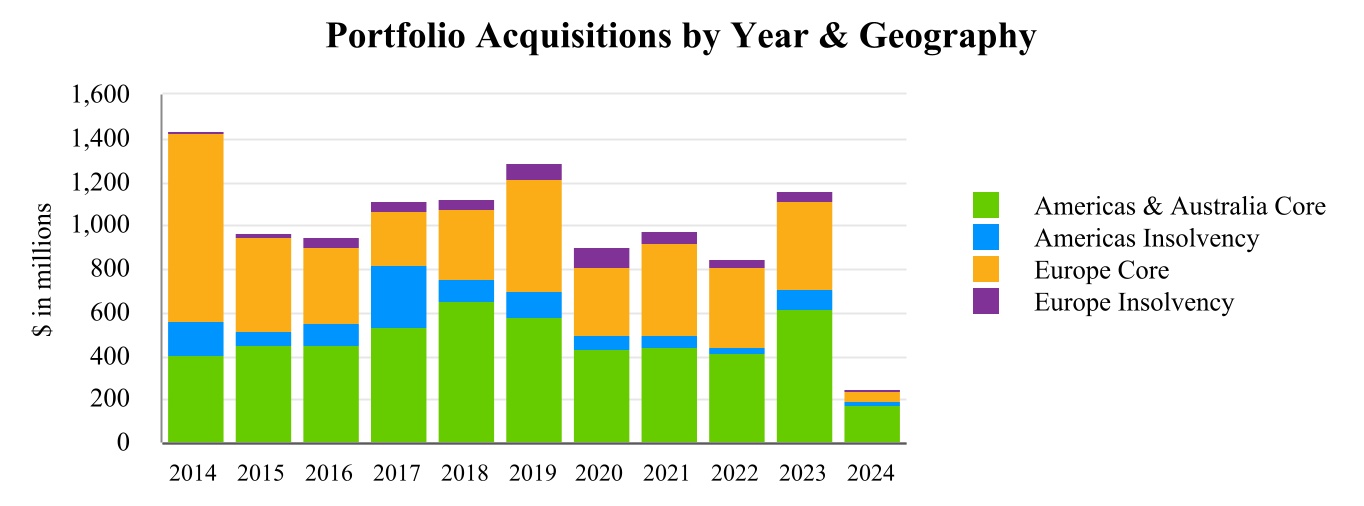

•Total portfolio purchases of $245.8 million.

•Total cash collections of $449.5 million.

•Cash efficiency ratio of 58.0%.

•Diluted earnings per share of $0.09.

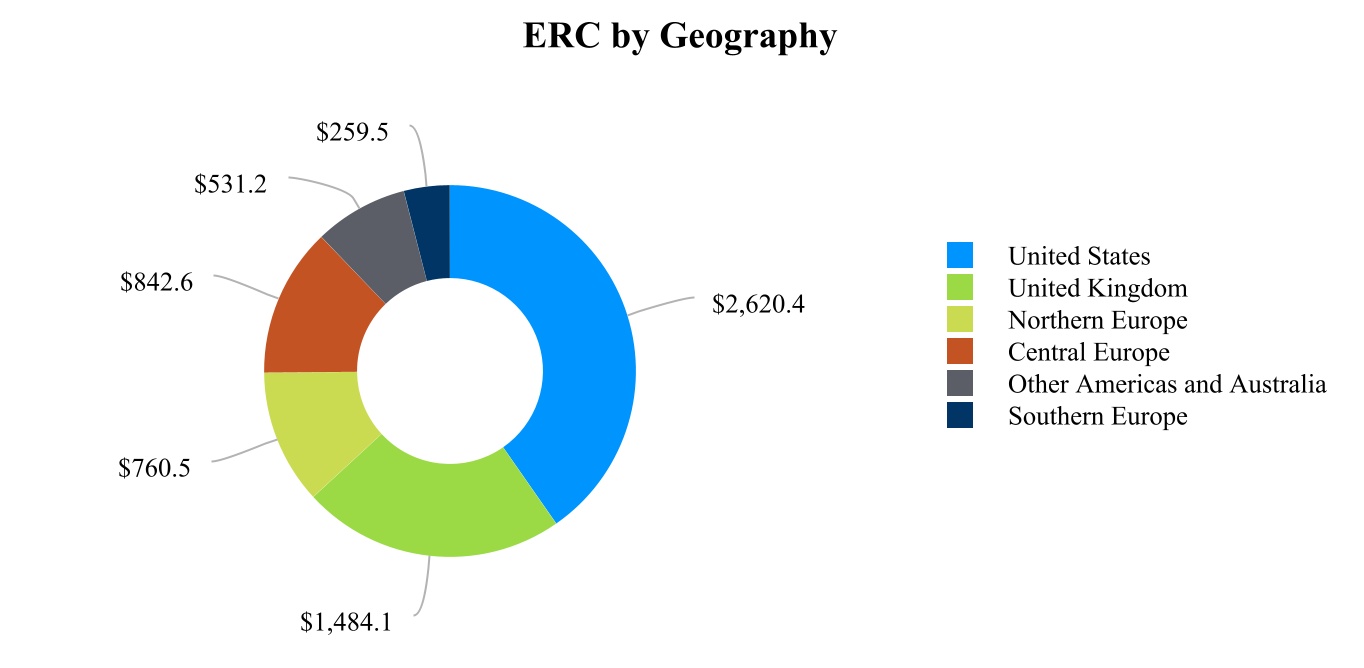

•ERC of $6.5 billion as of March 31, 2024.

Building on the momentum from last year, we began 2024 on a positive note, with higher cash collections in the Americas and Europe compared to Q1 2023. Although we are seeing fewer large one-time payments in the U.S. and some markets in Europe, our level of customer engagement and the proportion of customers paying us both remain fairly steady.

We remain disciplined with regards to pricing and are strategically deploying capital in the markets where we see the most attractive returns, and the combination of increased purchases and improved pricing is positively impacting portfolio income. Our roadmap to enhanced profitability is centered on the creation of value from higher cash collections, while reducing marginal costs, and is supported by three pillars:

1.Optimizing investments - increasing ERC and portfolio returns.

2.Driving operational execution - maximizing cash collected per dollar invested.

3.Managing expenses - optimizing our cost structure.

In the U.S., we continue to capitalize on the significant growth in U.S. portfolio supply driven by credit normalization. We recorded our second highest Q1 U.S. investment level in Company history and expect strong portfolio investments to continue. There is a strong correlation between U.S. credit card charge-off rates and our U.S. portfolio purchases, and in recent years, we have seen industry credit card balances and delinquency and charge-off rates continue to rise. Across our U.S. call centers, we have continued to refine and optimize our customer contact strategies and built capacity to support portfolio growth. We have also made improvements to our overall legal collection processes, and we are encouraged by the pace at which we are realizing cash collections from these process enhancements. In Brazil, our cash collections in Q1 2024 continued to benefit from higher recent purchasing levels.

In Europe, investment opportunities are less predictable than the U.S., since the market is more spot-driven, and we have not seen large spot transactions similar to those that have come to market previously. The volume of portfolios available for sale in Q1 2024 was lower than normal, however, we are seeing an uptick in market volumes, and we expect that our investments in the second quarter will align more closely with long-term trends.

Summary of Selected Financial Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of or for the period ended (in thousands, except per share, ratio, headcount data or where otherwise noted) | | March 31,

2024 | | March 31,

2023 | | Change | | | | | | |

| Selected Income statement data: | | | | | | | | | | | | | | | | | | |

| Portfolio income | | $ | 202,056 | | | | | $ | 188,242 | | | $ | 13,814 | | | | | | | | | | | |

| As a % of total revenues | | 79.1 | % | | | | 121.1 | % | | (42.0) | % | | | | | | | | | | |

| Changes in expected recoveries | | 51,674 | | | | | (36,912) | | | 88,586 | | | | | | | | | | | |

| As a % of total revenues | | 20.2 | % | | | | (23.7) | % | | 43.9 | % | | | | | | | | | | |

| Operating expenses | | 189,190 | | | | | 189,114 | | | 76 | | | | | | | | | | | |

| As a % of total revenues | | 74.0 | % | | | | 121.6 | % | | (47.6) | % | | | | | | | | | | |

| Interest expense, net | | 52,278 | | | | | 38,283 | | | 13,995 | | | | | | | | | | | |

| As a % of total revenues | | 20.5 | % | | | | 24.6 | % | | (4.1) | % | | | | | | | | | | |

| Income tax expense/(benefit) | | 2,386 | | | | | (18,683) | | | 21,069 | | | | | | | | | | | |

| As a % of total revenues | | 0.9 | % | | | | (12.0) | % | | 12.9 | % | | | | | | | | | | |

| Net income/(loss) attributable to PRA Group | | 3,475 | | | | | (58,629) | | | 62,104 | | | | | | | | | | | |

| As a % of total revenues | | 1.4 | % | | | | (37.7) | % | | 39.1 | % | | | | | | | | | | |

| Common share data: | | | | | | | | | | | | | | | | | | |

| Diluted earnings per share | | $ | 0.09 | | | | | $ | (1.50) | | | $ | 1.59 | | | | | | | | | | | |

| Diluted average common shares outstanding | | 39,448 | | | | | 39,033 | | | 415 | | | | | | | | | | | |

| Common shares outstanding (period-end) | | 39,345 | | | | | 39,170 | | | 175 | | | | | | | | | | | |

| Portfolio volumes: | | | | | | | | | | | | | | | | | | |

| Total portfolio purchases | | $ | 245,817 | | | | | $ | 230,225 | | | $ | 15,592 | | | | | | | | | | | |

| Total cash collections | | 449,518 | | | | | 411,284 | | | 38,234 | | | | | | | | | | | |

| Estimated remaining collections | | 6,498,172 | | | | | 5,674,681 | | | 823,491 | | | | | | | | | | | |

| Selected Balance sheet data (period-end): | | | | | | | | | | | | | | | | | | |

| Finance receivables, net | | $ | 3,650,195 | | | | | $ | 3,286,497 | | | $ | 363,698 | | | | | | | | | | | |

| Borrowings | | 2,953,048 | | | | | 2,937,895 | | | 15,153 | | | | | | | | | | | |

| Total stockholders' equity - PRA Group, Inc. | | 1,129,326 | | | | | 1,158,343 | | | (29,017) | | | | | | | | | | | |

| Selected Performance data and ratios: | | | | | | | | | | | | | | | | | | |

Cash efficiency ratio (1) | | 58.0 | % | | | | 54.3 | % | | 3.7 | % | | | | | | | | | | |